Case study: maximizing government grants for your RESP

The RESP is for everyone

Lower-income families, wealthy couples with an only child, grandparents with several grandchildren to spoil: what do they have in common? They all can, one way or another, take advantage of the government grants paid into the registered education savings plan (RESP) and provide financial support to a child pursuing post-secondary education.

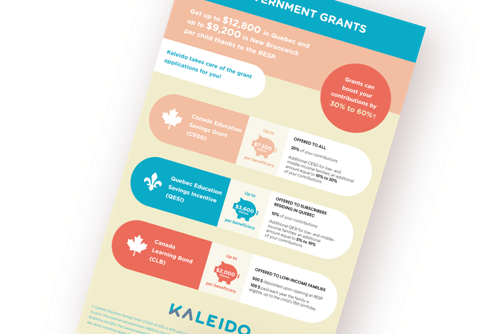

The biggest advantage the RESP provides is access to generous government grants. Think about it! You could receive up to $12,800 per child in Quebec and up to $9,200 in New Brunswick.1 Whether you’re financially comfortable or have a tight budget, discover how your family can make the most of grants!

Grants: the government pitches in

No other savings vehicle compares to the RESP. What makes it so appealing and profitable is the fact that both the Government of Canada and the Government of Quebec offer grants which boost your contributions. The “Grants” section of our website contains a wealth of information on the subject.

+20% thanks to the Canada Education Savings Grant (CESG)

Every eligible beneficiary can, under certain conditions, receive the basic CESG, which matches 20% of the contributions made in their RESP, up to a maximum of $500 per year per child ($1,000 if there’s unused grant room) and the lifetime amount of $7,200 per beneficiary. Beneficiaries from eligible low- and middle-income families could receive an extra 10% to 20% in additional CESG, up to a maximum of $100 per year per child and the lifetime cumulative amount of $7,200 per beneficiary.

+10% in Quebec thanks to the Quebec Education Savings Incentive (QESI)

The Government of Quebec also offers the Quebec Education Savings Incentive (QESI), which “was established to encourage Québec families to save more for the post-secondary education of their children and grandchildren, beginning in their infancy.”2

Eligible beneficiaries can receive an amount equal to 10% of the net annual contributions made in their RESP, up to a maximum of $250 per year! Furthermore, beneficiaries from eligible lower-income families could receive an extra 5% to 10% in additional QESI, up to a maximum of $50 per year.

Visit the websites of the Canada Revenue Agency and the Government of Quebec to learn more about the CESG and QESI.

$2,000 for every child thanks to the Canada Learning Bond (CLB)

With the CLB, lower-income families who open an RESP can save for their children’s post-secondary education without having to contribute themselves.

This help from the federal government, which is widely underused3, pays $500 per child the first year, then $100 annually until the child’s 15th birthday.

To determine CLB eligibility, the Canada Revenue Agency considers, among others, the number of children in the family and the adjusted net family income. The Government of Canada’s website provides further details regarding CLB eligibility criteria. Again, although the subscriber can choose to add to the RESP, no contribution is necessary to receive the CLB.

I want to become a customer

I’m already a customer

Want to see how profitable these grants could be for you? The 3 fictitious cases below illustrate the significant impact of the government grants paid into the RESP.

Julie and Louis4: 2 jobs, 1 child, 0 financial worries

Louis and Julie are in their thirties and the proud parents of a single child. Their financial situation is advantageous: since they each have a stable job, they have good financial leeway and know the RESP can help them get the most out of their investments.

They know that for each dollar invested in an RESP, they’ll get at least 30% in government grants in Quebec (20% in New Brunswick), regardless of income. That’s why as soon as their daughter Lea was born, they made the decision to invest the maximum: $2,500 per year per child, up to a lifetime limit of $50,000 per child.

With a 3% annual return, their monthly contribution of $208.33 (i.e., $2,500 per year) could, 17 years later, amount to a hefty sum of nearly $70,000!5 Julie and Louis did the math: to get the same results with a TFSA, they’d need a guaranteed annual return of nearly twice that amount. In their case, the RESP is a smart and advantageous choice. They also know that their contributions will be refunded tax-free at plan maturity if they want, while Lea will receive her Educational Assistance Payments (EAPs).

Emily4: 2 children, self-employed, little financial leeway

How could Emily, a mother of two and a freelancer with unstable income, contribute to an RESP? Her income is barely enough to make both ends meet!

She recently learned that low-income families can open an RESP and receive the CLB without having to invest a single cent. She decided to take advantage of that offer for her children aged 2 and 4.

Just with the CLB amounts paid by the government, Emily could accumulate over $4,0005 for her kids’ post-secondary education!

Paul and Suzan4: parents who make up for lost time with an RESP Loan

No need to be wealthy to help your children financially! That’s what Paul and Suzan, parents of 2 teenagers, realized. They already opened an RESP for each child several years ago, but have only been contributing $20 per month. As their teens are growing up and their career aspirations are shaping up, they’re looking for a way to give a final push to their education savings to make the most of the RESP without having to take away too much from their other savings.

With an RESP Loan, they were able to contribute enough to fully benefit from grants. Now, they can pay back their loan at their own pace knowing that with the 20% CESG and 10% QESI that were added to their contributions, their kids will benefit from an awesome gift!

In conclusion

No need to rack your brains very long to realize that, yes, the RESP is a powerful tool which can help you achieve your financial goals and support your children’s education. With a little bit of planning and generous grants, even small contributions can, with time, make a big difference.

Want to know how much you could recover?

Contact your scholarship plan representative directly or our Customer Service at 1-877-710-7377. We’ll gladly give you all the information you need on government grant maximization.

Download our short summary guide to learn all about the generous government grants associated with RESPs.

Find out in seconds how much an RESP could earn you with the free calculator.

1. Canada Education Savings Grant (CESG) from 20% to 40%. Quebec Education Savings Incentive (QESI) from 10% to 20%. Based on adjusted family net income. The annual limit is set at $600 for the CESG and at $300 for the QESI. The lifetime limit per beneficiary is set at $7,200 for the CESG and at $3,600 for the QESI. The Canada Learning Bond (CLB) is up to $2,000 per beneficiary and is offered for children born after December 31, 2003, from families who meet the financial criteria. Certain conditions apply; see our prospectus at kaleido.ca.

2. Government of Quebec (PDF document)

3. According to Statistics Canada, nearly 750,000 Quebecer children are eligible for the Canada Learning Bond (CLB). Among them, over 408,000 had not applied for it as at June 30, 2019.

4. Fictitious names.

5. Amounts for illustrative purposes only. Returns are not guaranteed. Hypotheses based on a 30% grant rate and a 3% annual rate of return.