Who? What? How Much? Everything You Should Know About the Quebec Education Savings Incentive (QESI)

Written by: Kaleido

What Is the Quebec Education Savings Incentive?

The Quebec Education Savings Incentive was established in 2007 by the Quebec Government to encourage families to save for the post-secondary education of their children.

The QESI is a refundable tax credit that is paid directly into a child’s RESP for their post-secondary education.

Is My Child Eligible for the QESI?

You’re wondering whether your child is entitled to receive the QESI? It’s very simple. To be eligible, your child must meet the following four conditions:

- Be less than 18 years old1;

- Have a social insurance number (SIN);

- Be resident in Quebec on December 31st of the taxation year;

- Be the designated beneficiary of an RESP.

How Can I Benefit from the Quebec Education Savings Incentive?

If you want to benefit from the QESI, simply choose an RESP provider that offers this incentive.

For example, you could go with:

- A financial institution, i.e., a bank, a trust company, or a securities dealer;

- A financial service provider;

- A group plan provider.

How Much Can I Receive in QESI?

This is also pretty straightforward. The basic QESI equals 10% of your annual contribution in an RESP, up to a maximum of $250 each year.

Unused grants from previous years can be added to the basic amount of the annual grant, for a total of $500 per year maximum.

That’s everything you need to know!

A Simple Example of Calculation

Let’s take this scenario: you’re the proud parent of a child for whom you opened an RESP with a provider that offers the QESI—which is very important! When your little one was born in 2016, you started saving for post-secondary education by contributing the following sums:

- In 2016, you contributed $2,000

This means you received a $200 QESI payment ($2,000 x 10%). You still had $50 in unused grant room left ($250 – $200).

- In 2017, you contributed $4,000

You didn’t receive $400 in QESI ($4,000 x 10%) but the maximum annual QESI amount ($250) plus the $50 in unused grant room from the previous year, so $300 in total.

You should know that if you’re a low- or middle-income family, you could receive an additional QESI amount (5 or 10%) on the first $500 you contribute:

- 5% if your family income ranges between $51,781 and $103,545 (for a maximum annual amount of $25 on top of the basic QESI);

- 10% if your family income is of $51,780 or less (for a maximum annual amount of $50 on top of the basic QESI).2

Contributing to an RESP: a Smart Choice and a Good Deal!

The QESI is meant especially for parents who wish to save for their children’s post-secondary education. Best-case scenario, the total QESI amount paid for your child could reach a maximum of $3,600.

All in all, the Quebec Education Savings Incentive significantly boosts your contributions. Don’t miss out!

I want to support a child by opening an RESP to save for post-secondary education!

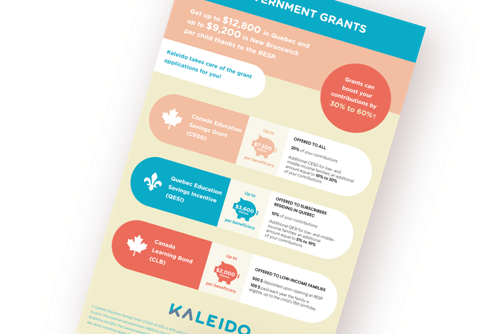

Download our short summary guide to learn all about the generous government grants associated with RESPs.

1. Special conditions apply if the child is 16 or 17 years old at the end of the taxation year. See our prospectus.

2. Family income thresholds for low- and middle-income households for determining the rate of financial assistance granted by the QESI for 2024, indexed annually.