Quebec Education Savings Incentive

Get up to $3,600 for your child’s RESP

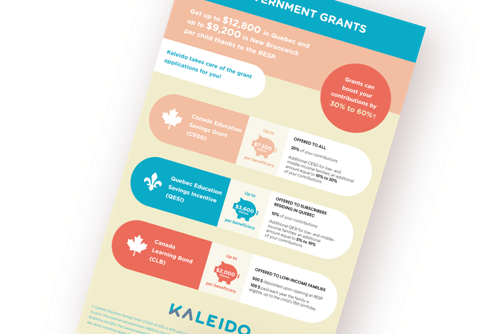

If your child is eligible for the Quebec Education Savings Incentive (QESI), it’s never been easier to save more for their post-secondary education. Kaleido will take care of applying for the grant for you, and the amount is paid directly into the beneficiary’s Registered Education Savings Plan (RESP). Don’t miss out on this helping hand from the government!

The QESI: An RESP grant for all Quebecers

The Quebec Education Savings Incentive (QESI) is a financial bonus that boosts your contributions to an RESP. It is a tax measure introduced by the Quebec government in 2007 to encourage Quebec families to save for their children’s post-secondary education.

Simple eligibility rules

To qualify for the QESI, your child must meet the following four conditions:

Be under 18 years of age.1

Have a Social Insurance Number (SIN).

Reside in Quebec on December 31 of the taxation year.

Be designated as the beneficiary of an RESP (if your child doesn’t have one, consider opening an RESP today).

Up to $3,600

The Quebec Education Savings Incentive (QESI) is a truly beneficial government program. Here are the ways this grant can provide a financial boost for your child’s post-secondary education:

- The basic QESI is equal to 10% of your annual RESP contribution, up to a maximum of $250 per year.

- Unused grants from previous years can be added to the basic amount of the annual grant, up to a maximum of $500 per year.

- The total QESI available to your child can be up to $3,600 lifetime, regardless of the number of RESPs.

- If you are a low- or middle-income family, you may be eligible for an additional amount (5% to 10%) on the first $500 in contributions.2 Eligibility for the additional QESI is based on adjusted family net income (the income levels are updated annually by the Government of Quebec).

Remember to contribute regularly to your RESP so you can get the maximum amount of grant money!

Getting the QESI is child’s play!

If you haven’t already done so, start by opening an RESP for your child. After that, here’s what happens:

╋ Kaleido takes care of the grant application for you.

╋ The amount will be deposited directly into your child’s RESP.

╋ When your beneficiary is enrolled in an eligible post-secondary program,3they can apply for an educational assistance payment (EAP) and receive the QESI money.

Open an RESP today to take advantage of the QESI and other grants. Kaleido helps you achieve your education savings goals!

Download our short summary guide to learn all about the generous government grants associated with RESPs.

Find out in seconds how much an RESP could earn you with the free calculator.

1. Certain conditions apply if the child is 16 or 17 years of age at the end of the taxation year. See our prospectus for details.

2. The additional grant is 5% if the adjusted family net income is between $46,296 and $92,580 (up to an additional $25 per year), and 10% if the adjusted family net income is $46,295 or less (up to an additional $50 per year). These are the 2022 adjusted family net income levels for low- and middle-income households; the levels are indexed annually.

3. See our prospectus for details on eligible programs.